- Menu

- Skip to right header navigation

- Skip to primary navigation

- Skip to main content

- Skip to primary sidebar

- Skip to footer

Policies & Codes

Grievance Redressal

We at Edelweiss Retail Finance Limited (“ERFL/Company”) are committed to serve to make our client’s experience a rewarding one at our Company. ERFL’s Grievance Redressal Mechanism articulates our objective to minimize instances that give rise to customer complaints and create a review mechanism to ensure consistently superior service behavior.

We ensure prompt redressal of all complaints and use it for effecting necessary changes to improve the services further. In case of any complaint/grievance, the borrowers / customers including the applicants with disability (ies) may contact through any of the following channels.

First Level: The borrowers can directly approach the Branch Manager and enter his/her complaint/grievance in the compliant register maintained at the branch. The concerned Branch Official shall guide the borrowers who wish to lodge a complaint. The borrower may also lodge complaints / grievances at the following email id : assistance@eclf.com

Second Level: The borrower / customer can also approach Grievance Redressal Officer at the following address :-

Mr. Ragvan TR

Edelweiss Retail Finance Limited

Ground Floor, Tower 3, Wing B, Kohinoor City Mall, Kohinoor City, Kirol Road, Kurla(W), Mumbai – 400070

Email id: grievances@eclf.com

landline no: +91 22-43428056 Monday – Friday (10 a.m. to 6 p.m.)

Grievance Redressal Officer shall endeavor to provide the borrower / applicant with the resolution / response to the queries / complaints / grievances received as earliest as possible.

Third Level: If the Complaint / grievance is not redressed within a period of one month, or / and the complainant is not satisfied with the reply,

the borrower / customer / complainant may appeal to the Ombudsman, Reserve Bank of India at

https://cms.rbi.org.in/ :-

as per the RBI Integrated Ombudsman scheme vide Ref.

CEPD. PRD. No.S873/13.01.001/2021-22 dated November 12, 2021.

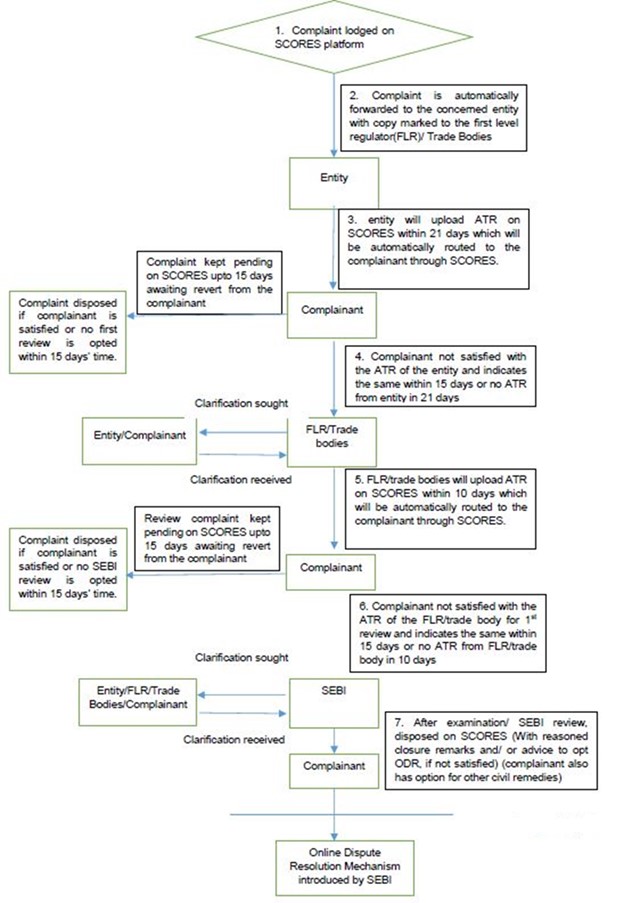

Grievance Redressal Mechanism – Investors

In case of any complaint/grievance, the investors may contact through the following channels:

|

Level 1

|

|

|

Level 2

|

|

|

Level 3

|

|

|

Level 4

|

|

Fair Practice Code & Ombudsman Scheme

Footer

Media & Press

- Zee News – How to make access to funds easier for MSMEs

- Economic Times – A primer for availing MSME business loans

- Mehernosh Tata, Head – SME Lending, Edelweiss Finance discusses how big data is going to be a lifesaver for SMEs

- SME World – Access to credit is key to empowering MSMEs says Mehernosh Tata, Head – SME Lending, Edelweiss Finance

- Banking Frontiers – Mehernosh Tata, Head – SME Lending, Edelweiss Finance says we have been at the forefront of testing & adopting several digital initiatives

Useful Links

- Home

- About Us

- SME Loan

- Loan Against Property

- Structured Collaterised Credit, Mortgage & Mid-corporate Lending

- Tools and Calculator

- Interest Rate, Fees and Charges

- Online Access

- Contact Us

- Download Document

- Vernacular Declaration

- Special Offers

- Benchmark Rates

- Ex-gratia Payment Scheme

- Covid 19 – Moratorium

- Digital Partners

- List of Terminated Service Providers

- Customer Education Literature – Asset Classification Concepts

- Property Sale

- Secured assets possessed under the SARFAESI Act, 2002

- Unclaimed Interest/Redemption amounts on NCDs

- List of Recovery Agents